The Mindfully Rich Podcast

🎧💰 Introducing The Mindfully Rich Podcast 💰🎧

Hosted by Gina 'RichE' Richardson, a financial wellness expert with 18 years of experience in the financial industry, The Mindfully Rich Podcast is where real money conversations meet authentic insights. Drawing from nearly two decades in corporate banking and finance, Gina offers a unique insider's perspective on the financial landscape, making complex money matters relatable and actionable.

💡 Why did I create this podcast? Because I’ve seen firsthand how financial literacy—or the lack thereof—can impact lives. My mission is to empower you to elevate your financial wellness and awareness by providing valuable insights that lead to healthier money habits. Each week, I break down the essentials of managing your money, from credit building and debt elimination to setting and achieving financial goals.

📚 Whether you're a college student looking to build a solid financial foundation or a middle-class earner striving to improve your financial knowledge and habits, this podcast is for you. Join me every Monday as we dive into real conversations about money, share practical advice, and uncover the financial truths that will help you elevate your financial game.

Don’t forget to LIKE 👍, SHARE 📲, and REVIEW 📝 to show your support for the podcast!

Topics Covered:

- 📈 Credit Building and Rebuilding

- 💳 Debt Repayment and Elimination

- 🎯 Money Goals and Financial Planning

- 🧠 Real Financial Wisdom and Practical Advice

Hashtags: #TheMindfullyRichPodcast 🎙️ #MoneyPodcast 💵 #FinancialWellness 🌱 #MoneyMatters 🏦 #CreditBuilding 💪 #DebtElimination 🚫 #FinancialGoals 🎯 #FinancialLiteracy 📚

The Mindfully Rich Podcast

Conversation #127 | Is The Check Engine Light On In Your Finances Episode? (Part 1)

It's National Financial Capabilities Month, and of course, as your financial guide, I have some new insight to share with ya'll! Welcome back to The Mindfully Rich Podcast, your weekly dose of financial wisdom with a twist!

Join me, your host, Gina RichE Richardson, as I explore real-life situations and offer practical advice to help you improve your relationship with money and build better financial habits.

In this episode, I'll dive into a crucial question: Is the check engine light on in your finances? Drawing inspiration from a recent experience with her car's warning light, I'll relate this to the importance of regular maintenance checks for vehicles and finances. Just as a check engine light alerts us to potential issues under the hood, specific symptoms in our finances indicate the need for immediate attention.

From living paycheck to paycheck and accumulating credit card debt to experiencing stress and anxiety about finances, I'll be identifying common triggers that signal financial distress. She emphasizes the importance of promptly addressing these warning signs to prevent further damage, likening financial health to maintaining a car engine.

Through candid discussion and relatable anecdotes, I encourage listeners to confront financial challenges head-on and seek tailored solutions for their unique situations. Join her as she unpacks the complexities of personal finance and offers insights to help you navigate your financial journey with confidence and resilience.

Tune in to The Mindfully Rich Podcast for valuable tips, empowering conversations, and a fresh perspective on achieving financial well-being.

Don't miss out—your financial future starts here!

Be sure to subscribe, share, and leave a review!

Book Me As Your Financial Guide

Over the past three years, my podcast has been a treasure trove of valuable money tips, with each of its 100 episodes packed with unique insights and strategies. PERIODT!!!

If you're ready to take your finances to the next level in 2024 and need a winning strategy to achieve your goals, I encourage you to visit my website, www.iammindfullyrich.com. There, you can schedule a complimentary consultation with me, during which we can discuss your financial situation and explore how my wealth of experience can benefit you. Let's rise together!

Connect With The Podcast on Instagram

Keep up with the pod on Instagram - @mindfully_rich_podcast

🖤LISTEN 🖤SUBSCRIBE 🖤SHARE

🖤Advertise or Sponsor The Podcast | Email -mindfullyrich@iammindfullyrich.com

Hello, hello, and welcome back to the Mindfully Rich podcast, your weekly look at life in finances with a twist, where we talk about improving your overall relationship with money and building better financial habits. On each episode, I'll discuss real life situations and give y'all practical advice. The point of this podcast is to help you stay in your financial lane so you won't end up broke. I'm the creator and host, gina Ritchie Richardson. Now let's jump into today's conversation. What's up y'all and welcome back. Y'all already know that I'm a gratitude person, so got to start the episode off thanking y'all, thank you, thank you, thank you. Y'all was really listening. Okay, y'all must be excited that your girl is back. Okay, appreciate that. And so, for all of y'all was really listening. Okay, y'all must be excited that your girl is back. Okay, appreciate that. And so, for all y'all that's listening, stay a little while while you're here, make sure you listen and make sure you share. For those of y'all that are new, you don't know this, but y'all, my marketing team, okay, this is a one woman show over here, so y'all make sure you spread this episode far and wide. Okay, tell a friend to tell a friend. Get in your circles, let them know. Y'all listening to the Mindfully Rich podcast. What's up? Okay, Share it on your social medias, do all of the things, okay, and then what you're going to do next week, you come on back so you can listen again. Okay, that's the cycle. That's what we do over here. Okay, and so, once again, real talk. Without y'all listening, I wouldn't have an audience, and y'all are such a supportive audience.

Speaker 1:I've gotten a lot of praise from lots of people just saying that they were thankful that the podcast is back. Hearing the episodes just takes them back. I mean, all of the things. It just gave me all the warm and fuzzies, and so thank you to all of y'all who have been reaching out, and so please know that I, to all of y'all who have been reaching out, and so please know that I see all of the things. Don't forget to write a review. If you love the podcast, make sure you write a review to let everybody else know that you love it. So whatever platform you're listening on, you can go ahead and write a review on that particular platform.

Speaker 1:Okay, All right, y'all, it is National Financial Capacities Month. I'm sorry, I said capacities. I ain't doing this over. It's National Financial Capabilities Month. Okay, the reason why I'm stumbling over it is because for 20 years it's been National Financial Literacy Month, and so that word literacy makes some people feel a certain type of way, and so it changed to National Financial Capabilities Month, and so, basically, just equipping people with the awareness of finances, educating them on all of the things financial giving, resources, things of that sort that's what this month is intended to do, even though we talk about money and finance all the time. Okay, we don't need a month to do it. Okay, but I decided for this month I wanted to kind of dive into some topics that aren't normally highlighted in your normal, let's say, quote unquote, national financial capabilities month type of talk. Okay, you're used to your budget, your spending money, credit. We're going to get into some of those things, but I'm going to talk about it in a different way. I'm excited to jump into today's episode. Let's go ahead and move on into our mindful money moment.

Speaker 1:For those of y'all that are new, I started this podcast with a music title inspiration. So what I would do, because I love music, I would take a title of a song and use that as the topic point for what we talk about. So I don't have one for this week. It's cool, though. The title itself sells the episode, okay. So the question that I am posing to y'all for our topic today is is the check engine light on in your finances? Okay, okay, I told y'all right, okay, all of y'all gags. Y'all was like, right, I know, I know it's juicy, and so what made me think of this was cause I had a whole different episode planned, but I was like, nope, forget all that.

Speaker 1:I'm like the pastors when they got a whole sermon ready, but some in the room felt different. Okay, there was a different energy and the Holy Spirit moved. Okay, that's what happened with me, okay. So Sunday I was coming home from church and my check engine light came on and I was like, ah, what are you doing? Why are you on? Okay, and so some backstory.

Speaker 1:My car is a 2016 and I've had her for a minute, okay, and this is the longest car that I've kept, cause I normally would switch cars like every two to three years. Okay, but this one I loved. I don't know what it is. My Impala is my baby. Okay, I never named her, but she's a she, but she a roughneck she, okay, like she a me. Okay, she also from Chicago, too okay. And so we be riding. We be riding okay, and she didn't been with me for a long time and didn't been through all of my financial, my financial and my life transitions, heartaches, pains, all of the things and she still look good.

Speaker 1:And so I had to know that I have an almost eight-year-old car, that something was going to start happening, just because with cars, you have maintenance needs that are going to come up with your cars. And so when the check engine light came on, I was like dang. And so I immediately took it over to AutoZone. Just because I don't play with check engine lights, okay, this thing got to take me from point A to point B. I don't play around with that. Okay, that ain't what we doing over here, that ain't, that ain't how we get down. So I make sure that all of those needs of something. If a light pop up, I don't care if it's a light, okay, we need to, we need to go get it checked, we need to figure it out, all right.

Speaker 1:And so I went and got a diagnosis from AutoZone and I found out what it was. So this is Sunday, not too many repair shops. I'm like hell. I don't think it's a lot of anything open on Sundays for repairs. So I waited until this morning, and so, early this morning, seven o'clock, I go ahead and get with Chevy.

Speaker 1:Okay and sad note, I'm one of those people that always goes to the dealership. I don't know what it is, because I bought my car brand new. I started off with the dealership. I'm just continuing to go to the dealership because I ain't never had no problems. Now let me tell you what happened when I veered off from the dealership and people was like Ooh, go to like a regular repair shop, blah, blah, blah. Let me tell you what happened when I did that. I had an issue. I went it was supposed to be a small issue, right, it was a $250 issue, okay. And so what happened was when that happened.

Speaker 1:I took the car there and I don't know what it was, but everything went wrong after that. I was like wait a minute, wait a minute. The thing that needed to be fixed wasn't fixed because the check engine light had came on. For that as well and I'm trying to remember, like I'm trying to make sure I got my words right the check engine light ended up coming on again. I took it back to be diagnosed in the same problem that they said that they had fixed wasn't fixed.

Speaker 1:So then, when I took it back, for them to look at it again, which is wasting my time I am a person you listen to this podcast long enough. I do not like my time wasted. Okay, my time is money, all right. And so the same issue was popping up. They checked and they said, oh, the part that we put on there was faulty. How you put a faulty part on there. When you told me you charged me for a brand new part. Okay, so what is all that about? All right, and so making me go days without my car, it was just like a lot.

Speaker 1:And so when I go to the dealership, I don't have to worry about all that. It's going to be more. Yes, I get that, but I pay for convenience. I'm a person that pays for convenience, unless y'all got a repair shop and they, on point, send them to me. But right now I ain't been able to find one, and so, because of that dealership, we go, all right. And so took it to the dealership. Let it be to get. I already got the diagnosis, but they still got to check it, as they say. I think that's just another way to charge me some more money. But anyways, I was like I just need it repaired, fix it now, okay.

Speaker 1:And so thinking about that made me think about our finances, and it made me think about are your finances in dire need of a checkup? Are your finances showing you that a check engine light is on right now? And y'all are probably like, okay, so what does that look like? What does that look like in my finances when the check engine light is on? So, just like in a car, the check engine light is indicating that there is potential issues under the hood. So several symptoms can be going on right now, okay, and just like with the car, your finances can have some symptoms as well. And so, just because I like to be real with y'all, because we a family okay, it's just y'all and me. Right now, we're going to be. Let's be real with ourselves. Okay, ain't nobody looking at this, but you, you just listening, okay.

Speaker 1:And so some of those triggers and those symptoms that are indicating that your financial check engine light is on is, if you're living paycheck to paycheck, y'all probably be like, ooh, you better get off my neck right now, girl. Okay, this is going to be one of them episodes. Okay, it's going to feel hot up in here. Okay, it's going to feel hot. And so I've been doing some research on paycheck to paycheck. And because y'all know, I'm a certified financial educator, so I'm always out and I do financial educational workshops for people of different income brackets, and so I get a chance to talk to people who may not make a lot of money and those people who make a lot of money on paper but they're not feeling it in their actual finances.

Speaker 1:I also am a financial guide. I love that word better than a coach. I'm a guide, so I work with people, whether that's one-on-one or I'm working with couples so that they can get diagnosis and solutions to their problems that are going on and I don't like to call them problems to the things, to the symptoms and triggers let's say that right, because problems always feel like such a hard word to the issues that are going on in their finances. And so I can be a guide in that aspect. And so, living paycheck to paycheck. There's more to this. Just because life is expensive and a lot of people they're not going to admit that to you, they're not going to tell you that they live in paycheck to paycheck. We all got different lifestyles that we have to fund, and so I saw a recent study that showed that there are more people who are making over $100,000 who are living paycheck to paycheck.

Speaker 1:I don't have the percentage at this point. I was going to make something up and y'all probably would have believed it, but because I'm such a fat person, I'm not going to say it, but I believe the percentage was somewhere between 20 and 40%. That's a lot of people and I know under a hundred percent that percentage was up. So those people who are making under a hundred percent, I believe that percentage was somewhere, but it was over 50, but under 70. So that's still a lot of people who are living paycheck to paycheck. All right, and this comes from life can happen.

Speaker 1:If you listen to the last episode talked about different financial seasons, going from transitional all the way up to your harvest season. That transitional season, child, that's something okay. Something didn't happen in your life, okay. Job loss, loss of some sort, whether that's people, job, career, whatever it is right, I get it. Whatever the situation is, if you're living paycheck to paycheck and you're in it for whatever reason, that is a trigger and that is a symptom that your financial check engine light is on, all right. So another trigger is are you taking on more credit card debt? Now, this can be debt in general, okay, because you could be going out getting personal loans, but are you taking on more credit card debt? And so something that happens when you're living paycheck to paycheck. You normally don't have enough money to pay for your normal living and your lifestyle, and so lots of people they start using their credit cards to supplement their everyday expenses, their everyday debts, and so that's when you start robbing Peter to pay Paul, because you actually robbing yourself. And so if this is touching the nerve and if this is feeling like you, okay, this is a symptom that your check engine light is on, all right.

Speaker 1:So the next one is is your checking account starting to be overdrawn more often? Y'all know what I'm talking about. I didn't been there before. I ain't been there in a while, but I was there before, okay. So I know, living paycheck to paycheck money looking funny, everything not right, and you start being overdrawn. You start needing extra monies to pay for those bills that are coming out of your account because you don't have the money in there. You wait until your next paycheck, you waiting for some more dollars to hit the account before you can pay, but you're taking your account, overdrawing it, essentially so that you can get the things that you need to get paid paid for. Now, while you're going overdrawn, you're getting all these fees in addition to the overdrawn that you're having, and so let me just tell you this there is no judgment here. We are here to talk about it so we can get to what are those solutions? All right, but if you are noticing that you're overdrawing your checking account a little bit more, that's giving you a sign that your check engine light is on, all right.

Speaker 1:Next, is your credit score going down. Now, all right Credit scores. They start to go down when we start to accumulate more debt on our credit cards. So when we start keeping balances on our credit cards and those balances they get up there, that means that score is now going to start dropping because you're keeping more debt on those actual cards. Or are you not paying your debts on time Because the debts that are listed on your credit report your credit cards, personal loans, student loans, mortgages, auto loans, all of the things that you get I think there's some of those like affirms, and some of those things are listed on your credit report as well. Whatever is a bill that is listed on your credit report, if you're not paying it, it is now being listed as 30, 60, 90, 120, or 150 days past due. Are you at a point where your score is going down because of one of those things are happening? And if you are, then that means your check engine light is on All right.

Speaker 1:Another symptom are you unable to save for your retirement, like you want to start saving for your future, but you feel like you need every single penny from your paycheck right now. I need every penny right now. You feel that you don't have no room so that you're even able to save for your retirement, or you feel that there is no room for you to save period. You're unable to pay yourself first. If you're not, then your check engine light is on. If stress and anxiety is building up, those levels are extra high and you know it's because of your financial situation your check engine light is on. And lastly, if you are avoiding collection calls, if you are avoiding going to get the mail because you're getting something in the mail that's showing that you passed due, you don't want the people to find you. You're just like, oh my God, this is so overwhelming, I can't do this. If you are in that situation, your check engine light is on in your finances, and what we're doing now is just pointing it out.

Speaker 1:These are not all the symptoms, because there could be some other things that's going on in your life. We are all unique. There can be some other things that are going on that are indicating that your check engine light is on, and that's the one thing I can tell you about check engine light, child. Okay, you can only run with a check engine light on for so long.

Speaker 1:After that, what's going to happen? Okay, that engine going to stop, and what's going to happen to you If you continue in these situations that I've named, you going to stop. It's going to get worse, and continue to get worse until you do something about it. All right, so for some of y'all out there who don't know how I talk, I know worse is not a word. Okay, I'm trying to describe the situation, okay, and so this is the thing.

Speaker 1:I'm trying to bring some light to this. These are some serious symptoms that will require a solution quickly, okay, and so I want to make sure that y'all understand the severity of your financial check engine light and when it's on, and recognize that it's on, because I know we good at lying to ourselves, okay, if we're going to lie to somebody that is on, because I know we good at lying to ourselves, okay, if we're going to lie to somebody, we're going to lie to ourselves, real good. But what I want you to do okay, I'm your money girl I want to make sure that you are paying attention to these things that are happening in your finances so that you can know when your financial check engine light is on, when it's time for you to make a change in your life. Okay, our finances are so complex. I understand that. That's just like if 50 of us had our check engine lights on right now, there could be 50 different diagnosis. There could be 50 different solutions for us to solve it. So everybody is unique, all right. So I want you to know that what somebody else does for their check engine light may not be the same solution for you in your life.

Speaker 1:We're going to get into some solutions on the next episode, ok, this is to bring y'all back. But then also, I want to also add this and I've been saying this a lot this year. I want all of us to win in our finances. If you need help, you want to seek help. I tell y'all all the time.

Speaker 1:I am a financial guide. I have been in this financial world for the last 17 years. I am booking clients now, if you need your girl to come out, do a workshop for whoever it is, whoever your audience is. You want to get that preventative, that awareness out there about financial wellness and how to continue to maintain your financial well-being. Or you want me to talk about financial wellness and how to continue to maintain your financial wellbeing. Or you want me to talk about financial check engine lights? Okay, your girl is there, all right. Whatever you need, y'all make sure you check out my website that is, I am mindfully richcom so that way you can see where you book.

Speaker 1:I want to make sure that we are doing something about our finances this year. We are not just sitting here riding with check engine lights on. We doing something about it, we getting some solutions, okay. And so this is part one of the financial check engine light. Part two is coming up next week. It's already recorded. Okay, I did part two first. I had to. I ended up having to make this into two parts, and so it's already recorded. So next week you will get the next part, so you make sure that you stay tuned. I don't want to start rambling, so that's all I got, and got no more, and until next time when I hit y'all with another one.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

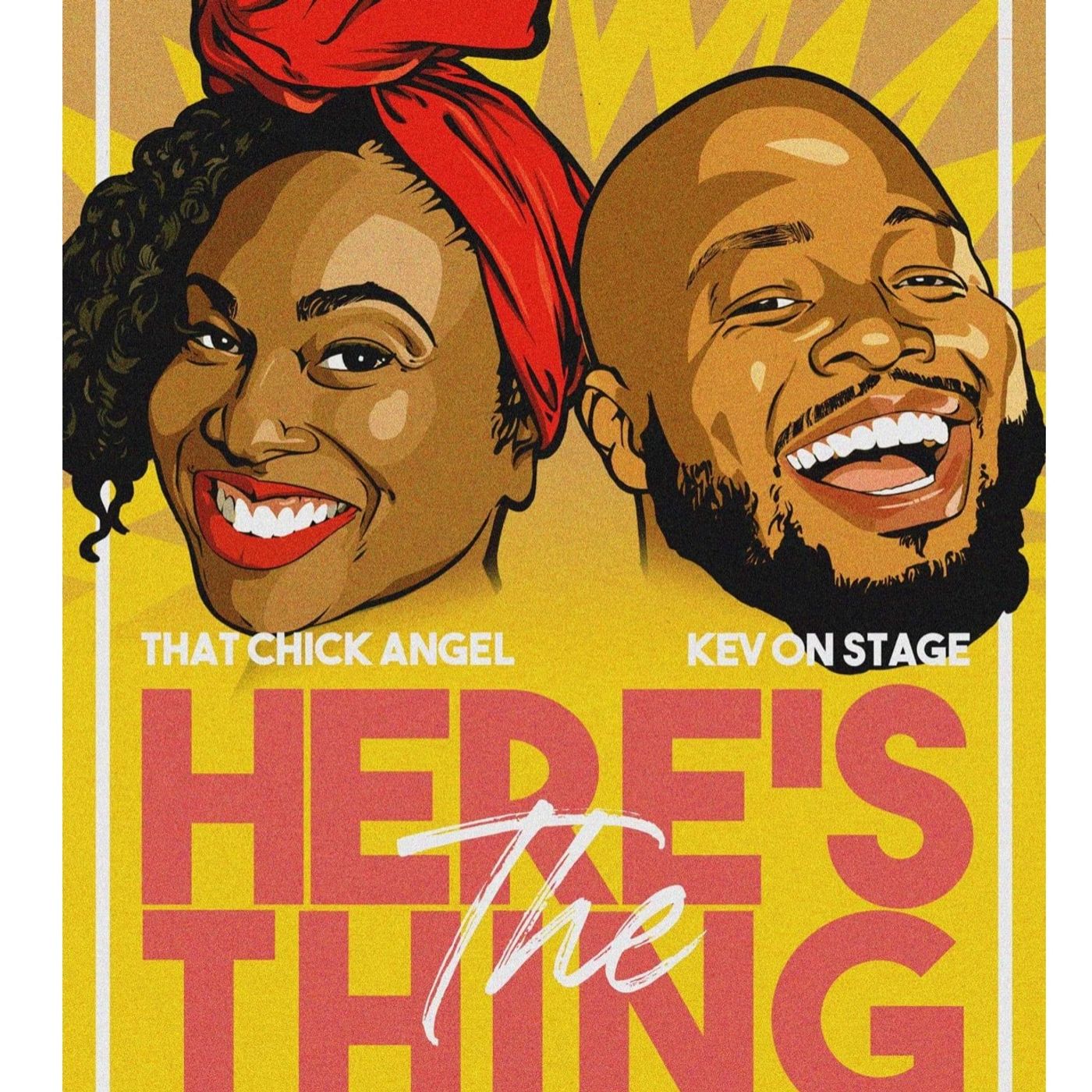

Here's The Thing

KevOnStage ThatChickAngelThe Friend Zone

Loud Speakers Network

Get Your Guy Coaching Podcast

Anwar White

Jade + X. D.

Loud Speakers Network

The Read

Loud Speakers Network

Girl CEO

GIRL CEO Network