The Mindfully Rich Podcast

🎧💰 Introducing The Mindfully Rich Podcast 💰🎧

Hosted by Gina 'RichE' Richardson, a financial wellness expert with 18 years of experience in the financial industry, The Mindfully Rich Podcast is where real money conversations meet authentic insights. Drawing from nearly two decades in corporate banking and finance, Gina offers a unique insider's perspective on the financial landscape, making complex money matters relatable and actionable.

💡 Why did I create this podcast? Because I’ve seen firsthand how financial literacy—or the lack thereof—can impact lives. My mission is to empower you to elevate your financial wellness and awareness by providing valuable insights that lead to healthier money habits. Each week, I break down the essentials of managing your money, from credit building and debt elimination to setting and achieving financial goals.

📚 Whether you're a college student looking to build a solid financial foundation or a middle-class earner striving to improve your financial knowledge and habits, this podcast is for you. Join me every Monday as we dive into real conversations about money, share practical advice, and uncover the financial truths that will help you elevate your financial game.

Don’t forget to LIKE 👍, SHARE 📲, and REVIEW 📝 to show your support for the podcast!

Topics Covered:

- 📈 Credit Building and Rebuilding

- 💳 Debt Repayment and Elimination

- 🎯 Money Goals and Financial Planning

- 🧠 Real Financial Wisdom and Practical Advice

Hashtags: #TheMindfullyRichPodcast 🎙️ #MoneyPodcast 💵 #FinancialWellness 🌱 #MoneyMatters 🏦 #CreditBuilding 💪 #DebtElimination 🚫 #FinancialGoals 🎯 #FinancialLiteracy 📚

The Mindfully Rich Podcast

Conversation #128 | Is The Check Engine Light On In Your Finances Episode? (Part 2)

Welcome back to Mindfully Rich Podcast for Part 2 of our special series, "Is The Check Engine Light On In Your Finances?" I'm your host, Gina RichE Richardson. Today, I'll continue the conversation we started last week, moving on to preventative maintenance, which you can do to prevent severe damage to your finances.

Drawing parallels between car maintenance and financial health, I stress the importance of regular financial check-ups, even when everything seems to run smoothly. Just as you wouldn't wait for the warning light in your car before taking action, proactive financial management is key to avoiding financial crises.

In this episode, I'll share three essential strategies for maximizing your financial health:

1. Prevention is Key: Similar to how regular oil changes and tire rotations prevent major issues with your car, staying on top of your finances can prevent small problems from escalating. I'll make sure to emphasize the importance of regularly reviewing your financial plan, budget, expenses, debts, and goals to catch potential issues early and take corrective action.

2. Maximize Your Financial Health: I'll highlight the significance of securing more income to increase wealth. Waiting until your financial situation reaches a critical point before seeking help is akin to waiting until you're seriously ill before seeing a doctor. Gina encourages listeners to assess their income streams and align them with their current and future financial goals.

3. Empower Yourself with Knowledge: Ignorance is not bliss regarding finances. I'll make sure to emphasize the importance of staying informed about your financial situation through regular check-ups. This knowledge empowers you to make informed decisions and take control of your financial future.

Through practical insights and actionable advice, I plan on equipping you with the tools to maintain your financial health and avoid waiting for the "Check Engine" light to come on in your finances. Proactive planning and regular check-ups are the keys to financial success.

Tune in to Mindfully Rich Podcast and take control of your financial future today!

Remember to subscribe, share, and leave a review!]

Book Me As Your Financial Guide

Over the past three years, my podcast has been a treasure trove of valuable money tips, with each of its 100 episodes packed with unique insights and strategies. PERIODT!!!

If you're ready to take your finances to the next level in 2024 and need a winning strategy to achieve your goals, I encourage you to visit my website, www.iammindfullyrich.com. You can schedule a complimentary consultation with me, during which we can discuss your financial situation and explore how my wealth of experience can benefit you. Let's rise together!

Connect With The Podcast on Instagram

Keep up with the pod on Instagram - @mindfully_rich_podcast

🖤LISTEN 🖤SUBSCRIBE 🖤SHARE

🖤Advertise or Sponsor The Podcast | Email -mindfullyrich@iammindfullyrich.com

Hello, hello, and welcome back to the Mindfully Rich podcast, your weekly look at life in finances with a twist, where we talk about improving your overall relationship with money and building better financial habits. On each episode, I'll discuss real life situations and give y'all practical advice. The point of this podcast is to help you stay in your financial lane so you won't end up broke. I'm the creator and host, gina Ritchie Richardson. Now let's jump into today's conversation. What's up? Y'all? We back, we back and we back on time period. Okay, and so y'all know how I love to start the episode off. Gotta start with gratitude, thanking each and every one of y'all. Thank you, thank you, thank you for all of the listens, thank you for all of the shares, thank you for being my marketing team just because this is a one woman team over here, okay, and I can't do it without y'all. Okay, word of mouth is what's going to make this podcast big, and so, with it being National Financial Capabilities Month, it used to be known as National Financial Literacy Month, but language changes as we get better. A lot of people didn't like that literacy word anyway, and so I just like to call it a month where finances and money as a whole is having more of an awareness around it, things that you can do to improve it, managing money, managing finances, credit all of those things where you're seeing a lot of people put information out there. Resources are being put out there. These months are important, even though here at the Mindfully Rich Podcast, we talk about money all the time, we always making sure that it's on your mind and making sure that you have something to think about and pointing you back in a direction of checking up on your finances, and so I'm glad that there is a month dedicated to it, because other people are putting that awareness out there this month as well. And so, with that being said, okay, I'm always talking about different topics that I believe can be of value and of benefit to you in your lives, and so this month in particular, I wanted to make sure that I was talking about more realistic topics, and I mean, let's be honest, I'm talking about real stuff all the time, but I wanted to do some things and share some light. I was trying to find the words, share some light on some topics that may be relevant in your lives right now, and so so far, it's been going pretty good. The listens are looking really good. So y'all continue to make sure y'all are sharing. Stay a little while, listen, write a review, do all of the things, okay. Then come back, repeat Okay, that is what we're doing here, okay. And so gotta send a shout out all of the things, okay. Then come back, repeat Okay, that is what we're doing here, okay. And so got to send a shout out all of the supporters, all of the people who have been sending me DMs, all of the support.

Speaker 1:Y'all been trying to figure out what's going on. You good, you back for real. I don't know. I'm taking it day by day y'all. But one thing I can tell y'all is that my excitement, my love, like my love meter, is filled up when I'm recording these podcasts. It's just sometimes, with life child life be lifin', all right, and when life is lifin' I don't be having the energy for it, but right now we on a good train.

Speaker 1:So if you haven't listened to the previous episodes from the previous weeks, make sure you go back, because today is a part two episode. So if you haven't listened to part one, I'm going to encourage you to stop right here and go ahead and go back to the last episode. I believe that's episode 127. It's conversation 127. Go back to that one first, because you're going to want to hear that first. Then come on back to this one. And so, once again, since I said it's a part two episode, there was not a music title inspiration for part one, so there is not one for part two because we keeping with the same name and so I'm moving ahead of myself, so we're going to just go ahead and move into the mindful money moment.

Speaker 1:And so last week I talked about and asked the question is the check engine light on in your finances? And so this is going to be part two to that episode. And yes, I know that this is a juicy topic. I said this last week I want to make sure that I'm preparing the room. Okay, it's just us, we talking. Some of these things may like hurt a little bit. Okay, you may feel something just because this may be you. Okay, especially the last episode. This one is more preventative, but something may stick out to you as Tig, I've been wanting to do that in my finances.

Speaker 1:I've been wanting to do this. You still can't. That's the reason why I do these podcast episodes is so we can shed light on things, that we may know what to do but aren't doing in our finances. So we can get back on a good path. Okay, I want all of us to win with our finances. That's been the theme of 2024. I want all of us to win in our finances. So my goal is to make sure that I'm talking about topics that are relevant to you, that are relatable to you, and that share some light on some things that you may need to do, and making sure you are sharing these with other people so that they can get this in the hands of whomever, so that way they can be doing the same thing.

Speaker 1:Ok, so, once again, this is part two, and I'm going to ask that question again, because I think this is a deep question Is the check engine light on in your finances? And so last week I talked about some different triggers and some symptoms that would show if the check engine light was on in your finances, and this is the thing. It's going to be different. I think I shared maybe seven, maybe seven or eight. There are so many other triggers and different symptoms that you can be experiencing. Remember, we are all unique, so we all going to have something different that is going to trigger us financially. That is going to show all right time to do something, all right, but for the most part, I named some general ones, and so this episode.

Speaker 1:I wanted to talk about some preventative measures, just because we don't have to wait until the check engine light is on. I started this because A couple of weeks ago, I had to go get my car serviced because the check engine light came on and it gave me like an aha moment for finances and I was like I'm running with this. We are keeping this, we're keeping this as a theme. We got some stuff coming up where we're keeping this going. Okay, I like this, just because it's a great analogy, because we don't have to wait until that check engine light comes on. There are lots of things that we can do as preventative methods so that our check engine light isn't coming on in our finances, and so I wanted to talk to you about three of those today.

Speaker 1:All right, so when we're talking about prevention, prevention is going to be better than any cure. That's just like when you get sick as a whole. When you get sick, you got to go through all of the time of being sick and then you got to wait on that cure to heal you. Okay, normally when you're sick, you can't just take. Sometimes you can, but not a lot of times. You can't just take medicine and boom, you're going to be better. It's going to take a while. That's just like with our cars. Okay, when that check engine light come on, it may take a while for you to get that vehicle fixed. Okay, some people drive on it for way longer than they should just because they're trying to see how far they can go before something actually happens.

Speaker 1:Really bad, and I don't want you to do that in your financial life. I don't want you to just see and just continue when to go, when you know you are at your end and you need to do something. Something needs to happen. So prevention is what I want us to concentrate on. Okay, just like when we talking about regular oil changes, rotations, all of those things. I want y'all to stay on top of your finances so you could prevent any small little issue that can turn into a snowballing effect and turn into a financial crisis in your life, because ain't nobody got time for that, all right.

Speaker 1:So how often are we regularly reviewing our personal financial plan, our budget? How often are we tracking our expenses and our debts. How often are we setting smart goals in our finances for our lives, like smart goals that are pertaining to right now, your mid future and your long-term future? How often are we doing that? Do you take those times out? When is your time to sit with your finances? And so I'm going to give y' girl. Okay. So it's apps out there. There are like the, the what is that called? Your, your banking app. It has a section where it will tell you where you're spending your money. It'll do all of the things.

Speaker 1:I'm not a digital girl when it comes to managing my finances. Now, there are some digital things that I do so that I can track, because, yes, I'm checking my account to track it, but when I'm goal setting, I got a notebook. That's just where I'm at. That's how I've been. That's what I like. I grew up with the elders. Okay, I grew up with my grandparents, and so that's how they did it. It's something about it. I like it. That's what I do. You can can do whatever works for you. If you got Excel, you got an app, you like pen and paper, whatever works for you, but set some time in your schedule, whether that's weekly, that's bi-weekly, that's monthly.

Speaker 1:I'm a type of girl I'm checking in on my finances weekly, so weekly I'm sitting down on a Sunday. Sometimes I'm outside. I like to be outside. Sometimes I just like to really be outside when I'm looking at my finances. So I may just sit on the steps, I may go to a park, I may do any of those things, just so I could check in and I can see where are we at financially. Are we hitting the goals? Are we where we should be? What's going on with the expenses? Am I spending too much money? Is the income incoming this month? Okay?

Speaker 1:So there's lots of different things that you can be checking up on in your finances, just because if something's off, then that means it's time for us to figure out a plan. We got to figure out some solutions. We got to. We got to figure out okay, what, what we're going to do? Okay, cause if the income ain't adding up, if the expenses and the debt's not being paid, if you feel that you're not achieving the goals that you set, if you're not saving what needs to be saved, there's something wrong and you don't want that to continue on. So you want to make sure that preventing a financial crisis before it happens, is going to be in your best. That's going to be in your best interest. I don't know how many times that I can stress that Okay. So what preventative measures can you do to make those financial check-ins with your finances? That's going to be an individual question for you. What can you do? I want you to think about that. Is that checking in with your finances every week, bi-weekly, monthly? What is that going to look like? Week, biweekly, monthly? What is that going to look like, and what is that going to be for you?

Speaker 1:Moving on, next, I want you to think about how you can maximize your financial health and wealth. So here I'm talking about money, securing the bag. How can we secure more income and this may be something that's on y'all mind Like, yeah, I have been thinking about how can I create multiple streams of income, or for those of y'all that's like you know what I'm making, all the money I'm good to go. Okay, I once used to think that too, but life is getting way more expensive than it used to be. Okay, the cost of living has gone up. Okay, yesterday's price is not today's price, inflation. It's continuing to go up, and so how are you thinking about securing your future financially? How are you securing your future financially, especially as the cost of living is going up? Is your income in a space where it'll continue going up as the cost of living is going up? Is your income in a space where it'll continue going up as the cost of living is going up? And if it's not, what are going to be those things that you're going to do in your life so that you can secure your own financial health and wealth?

Speaker 1:Just because I said this, I'm trying to figure out where did I say this at? I may not say it on the podcast, I'm what 128. So I'm sure I didn't say it before, but I just put it in a blog. You're not going to get rich nor wealthy off of working one job. You're just not. Okay, that's going to be enough. You're going to pay the bills. You may have more that goes above and beyond your bills. Okay, you're not going to get wealthy from that. You may be able to save some change and do some different things, but when we talking about real money, making sure that we're securing the real bags, that comes with multiple streams of income. So if one income goes out where I got another income coming in, or do I have a third income, a fourth income? Where? Where are those income sources coming from that can help secure and stabilize your financial health and your financial wealth?

Speaker 1:Just because I know that there are goals that we want to achieve. Those goals may not fit the income level that we have right now, but if we build multiple income streams, those goals may seem more like a reality. We can reach those things, and I don't know what those goals look like for you, whether that's you starting to invest, you becoming an entrepreneur, investing in businesses, real estate, if you are purchasing a home, if you're starting a family and you have different goals, child, because I don't know. I was sitting here about to try to go into everything. I don't know. I don't know what your goals are. We all have different goals and so you think of that. I want you to think of what do those goals look like? I want you to not just think about right now. I want you to think about later Retirement.

Speaker 1:Retirement has been a big one that I've been talking about, especially with millennials, just because I know it feels like it's far in the future. Okay, I'm turning 40 next year and I was sitting here like when did this happen? When did this happen? It feels like I'm getting older by the day, okay, and so that future is coming quicker than you may think. So you want to start thinking about that future.

Speaker 1:And retirement is an affordability game. If you don't have enough money to retire, you can't do it. I know back in the day it felt like all right, I'm just going to receive my social security, I'm going to get a pension, I'm going to get somebody's retirement plan for a 1K. Something's going to be paying out. Right. As a millennial, I don't even know if social security is going to even exist. I'm not getting a pension there's hardly any pensions out there, but there are some jobs that still have that. I have to secure my future now. I have to save that up. I have to do that. So I have to figure out what's going to be those income sources that's going to fund my future, because my future self is going to love me for thinking about it right now. So you get my drift. I want you to figure out what are those ways that you are going to be maximizing your income to secure and stabilize your financial health and wealth. All right, and so, moving on to the last thing that I want you to do as a preventative measure, so that your check engine light ain't coming on and ain't causing no financial crisis, is I want you to continue to stay a student of financial wellness. Continue to educate yourself, continue to build your knowledge when it comes to money and finances.

Speaker 1:Listening to this podcast y'all y'all know I love y'all. I love y'all listening. Okay, and this is good information. This is good ground that you are building. Okay, your foundation is good if you're listening to the Mindfully Rich podcast, but I know that there are other sources out there. There are some good people. There are some bad people. The bad people you're going to be able to weed out. You're going to see that they bad. The thing is, you want to look and diversify where you're getting your financial education, where you're getting your financial information and knowledge from, so that way you can build a better you and be more informed and be more aware. Know the resources that are available to you at whatever income range you're at. Understand what's going on in your finances so that way you're able to go back if something were to happen and you can go and you can work that solution with your finances.

Speaker 1:I tell my I like financial guide, right? So I tell all of the clients that I'm guiding. I want you to take part in this as well, because I want you to understand if this happens again because this is the thing about finances it may happen again. We go through financial seasons, for whatever reason. Something may happen. You may revisit a season more than once, but you want to know how do you get yourself out of that. Not that you can't seek assistance every time something happens. You can, okay, call me. Okay, iammindfullyrichcom. Okay, let me be your financial guide. Okay.

Speaker 1:Or if you want me to talk to your audience so I can guide them and we can talk about the topics your girl got you, but you want to understand how you can empower yourself and how you can get yourself through different financial seasons. If there is a financial crisis and there's something that's going on, you want to know, all right, where do I need to go first? What do I need to do? How do I start? If you're educating yourself and keeping yourself educated on financial matters, money matters, things that are pertaining to, let's say, credit, money management, all of the different topics, whatever it is If you're staying up to date on those things and you're diversifying where you're getting your information still here, I want to make sure that y'all know that.

Speaker 1:Still here, but making sure that you're continuing to do research in the area of money and finance that you need, okay, just so that you can know what to do, so that you can be empowered to move forward and not feel like I can't do nothing and get into a shell and then the check engine light comes on in your finances and you just sitting there. I wanna make sure that y'all are all empowered, okay, and that was the purpose of today's episode to talk about ways that you can continue empowering yourself and some preventative ways that you can keep your finances in one piece so that you can do those financial checkups. It's just like with our health, just like with our cars we have to make sure that our finances are in a healthy state. The only way that we can continue to make them in a healthy state is if we A because everything is powered from our income. A making sure income level is where it needs to be, because once it drops, that's when our financial health is dropping, that's when the stress levels are increasing, that's when the check engine light is closer and closer to coming on. So we have to make sure that we are securing our income, however way we're going to do it. If it's going to be one, if it's going to be multiple, I would encourage you to do multiple. Making sure those financial checks they are frequent enough so that you can see when something is going on.

Speaker 1:What do I need to cut back on? What am I doing right? What do I need to change? That's what we always want to have in mind. Or what could I be doing better on Making sure that we're doing smart goals with our lives?

Speaker 1:When we talk about smart goals, it has to be specific, it has to be measurable, it has to be achievable. I believe it's achievable. A are realistic. And then it also has to be timed, has to have a some type of time that you want to hit that goal, so that way you're able to see all right, I have a goal to save $20,000. I want to do it in the next three years. So you give yourself that time. You need it to be.

Speaker 1:Make sure that are they're realistic, okay, and so, once again, I want to make sure that I put it out there. I am a financial guide. So if you do need assistance y'all know I didn't get 128 episodes guiding you, giving you some perspective, talking about real topics, real things that are going on in our everyday lives, to assist you. I got an episode for everything. So if you need to go back, you can go ahead and do that. But if you need a little bit more assistance, call me. What's up? Let's see if we are fit.

Speaker 1:Okay, cause I want to make sure you're not feeling like you struggling and especially if you listening right now you feel like the check engine light is on in your finances. Uh-uh, let's go hit your girl up. Okay, cause we got to get you. We got to get you some solutions. We got to get solutions going. All right, whether it's me, whether it's somebody else, whether it's you doing your own research, you just want to make sure that you are doing something. All right, preventative is going to be the way to go when it comes to our finances, but if that check engine light on you is on in your finances, you need to find those solutions.

Speaker 1:And so y'all, I've enjoyed I feel like I was talking in cursive Y'all I have enjoyed doing these episodes for y'all. I hope that they have brought some type of value and they will benefit you in some type of way and have given you some type of perspective. Make sure you are sharing these episodes, writing the reviews Remember y'all, my marketing team. So get these episodes far and wide, child. That's the only way we're going to do it. And so thank y'all so much for listening. I don't want to continue to ramble, so that's all I got and got, no more. And until next time when I hit y'all with another one.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

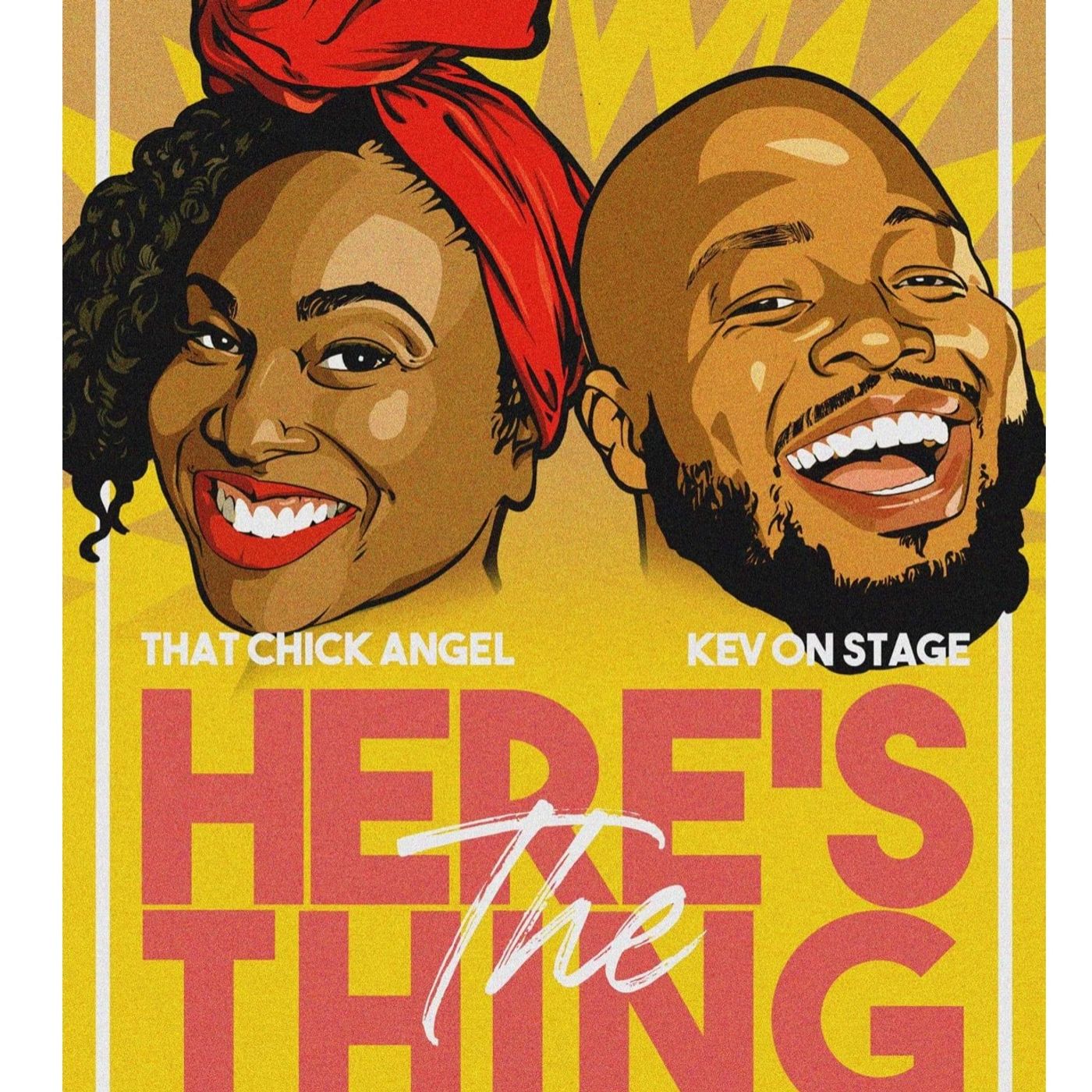

Here's The Thing

KevOnStage ThatChickAngelThe Friend Zone

Loud Speakers Network

Get Your Guy Coaching Podcast

Anwar White

Jade + X. D.

Loud Speakers Network

The Read

Loud Speakers Network

Girl CEO

GIRL CEO Network