The Mindfully Rich Podcast

🎧💰 Introducing The Mindfully Rich Podcast 💰🎧

Hosted by Gina 'RichE' Richardson, a financial wellness expert with 18 years of experience in the financial industry, The Mindfully Rich Podcast is where real money conversations meet authentic insights. Drawing from nearly two decades in corporate banking and finance, Gina offers a unique insider's perspective on the financial landscape, making complex money matters relatable and actionable.

💡 Why did I create this podcast? Because I’ve seen firsthand how financial literacy—or the lack thereof—can impact lives. My mission is to empower you to elevate your financial wellness and awareness by providing valuable insights that lead to healthier money habits. Each week, I break down the essentials of managing your money, from credit building and debt elimination to setting and achieving financial goals.

📚 Whether you're a college student looking to build a solid financial foundation or a middle-class earner striving to improve your financial knowledge and habits, this podcast is for you. Join me every Monday as we dive into real conversations about money, share practical advice, and uncover the financial truths that will help you elevate your financial game.

Don’t forget to LIKE 👍, SHARE 📲, and REVIEW 📝 to show your support for the podcast!

Topics Covered:

- 📈 Credit Building and Rebuilding

- 💳 Debt Repayment and Elimination

- 🎯 Money Goals and Financial Planning

- 🧠 Real Financial Wisdom and Practical Advice

Hashtags: #TheMindfullyRichPodcast 🎙️ #MoneyPodcast 💵 #FinancialWellness 🌱 #MoneyMatters 🏦 #CreditBuilding 💪 #DebtElimination 🚫 #FinancialGoals 🎯 #FinancialLiteracy 📚

The Mindfully Rich Podcast

Conversation #132 | From Financially Healthy to Vulnerable: The Accepting Your Financial Season Episode

In this episode of The Mindfully Rich Podcast, I break down the stages of financial wellness: Financially Healthy, Financially Coping, and Financially Vulnerable. Drawing from her experience as a Financial Educator, she explains how high-income earners can unexpectedly slip from Financially Healthy into Financial Vulnerability due to life events such as job loss, medical expenses, or lifestyle inflation.

I want you to understand critical strategies for avoiding and recovering from financial setbacks, including diversifying income streams, tightening budgets, and building emergency savings. Gina provides eye-opening statistics about how many high earners live paycheck to paycheck and actionable tips for long-term financial stability and recovery.

Whether you’re thriving or struggling financially, this episode will help you understand where you stand on the spectrum and guide you in making informed decisions to secure your financial future.

Key Takeaways:

- Recognize your current financial phase

- Diversify your income streams

- Live lean, even when income increases

- Build and maintain an emergency fund

- Invest in your skills for long-term stability

Don't miss out on strategies to rebuild and protect your financial well-being!

Visit www.iammindfullyrich.com for more tips and to schedule your consultation with me!

📲 Follow on Instagram: @mindfully_rich_podcast

🎙️ Hashtags: #MindfullyRichPodcast #FinancialWellness #MoneyManagement #FinancialRecovery

Hello, hello and welcome back to the Mindfully Rich podcast, your weekly look at life and finances with a twist, where we talk about improving your overall relationship with money and building better financial habits. On each episode, I'll discuss real life situations and give y'all practical advice. The point of this podcast is to help you stay in your financial lane so you won't end up broke. I'm the creator and host the Gina Richie Richardson. Now let's jump into today's conversation. What's up, y'all? What's up? Okay, look at what time it is. Okay, you probably got this episode in the morning Four weeks straight. Okay, yes, I'm making it a big deal because I am super excited that I have been consistent. Okay, your girl is back. I am having a good time. Y'all enjoying the episodes. I'm loving that. I'm loving all of the feedback that I've been receiving. Thank y'all so much. It is making me feel so good. I am so excited for this new iteration of the Mindfully Rich podcast. So, if you are new, welcome. We are the rich gang over here and this is a one woman show, and so, yeah, you just about to be kicking it with me. I'm going to be your friend in your head for the next 30 minutes. Thank you and welcome.

Speaker 1:Okay, so we have been talking a lot about a really deep topic, talking about the fall from six figures to scraping by. This is the last episode of this series. Y'all know I love a series and, if you knew, go ahead and go back. I got 131 whole episodes that you can listen to and you will see that there are so many different series that I have done. But I wanted to do this series for my high income earning audience, and the reason why I did that is because I've done so many different series, so many different series. Jesus Christ, did y'all hear that? Oh, my goodness, jesus Christ, did y'all hear that? Oh, my goodness, I've done a lot of episodes. Okay, this is 132 right now. Okay, so it's 131 of these things out there, and I've done different series before, but I wanted to do this one because it hit close to home, and it hit close to home with not only myself but a lot of people that I know out there who were once at six figures, who are trying to get themselves back to the place where they were at, or those high earning income folks that I know who have went through some of the things that we've been talking about in these series so far. So if you haven't checked out the previous episodes because this is episode four to a whole series and that series is called the Fall from Six Figures to Scraping by Make sure you go back and you go check it out, just because it all makes sense. Excuse me, y'all All right? So let's go ahead and go back to last week's episode where I talked about the climb back, restoring your income. Oh, my goodness, this episode was so therapeutic, just as the rest of them have been, but it was so therapeutic for me just to discuss, just because I talked about rebuilding your income streams and regaining that financial stability.

Speaker 1:Y'all going to hear me say this a lot. I'm very repetitive. I'm repetitive when I'm doing financial wellness workshops too, because I want to make sure that you're getting it. It all starts with our income, with the money that we are bringing in, and so anytime that money has slowed down in any area because let's say that you have multiple streams of income, so anytime it slows down, it has decreased that is when we start experiencing those falls and remember, just like with a regular fall, if I fall down a couple of steps, I may be cool, but if I fall down a flight of steps, meaning I have failed in income tens of thousands of dollars, then you're going to feel that impact a bit harder than if you just fell down a couple of steps. And so we talked about that. And so this week I am transitioning us, and so let's just go ahead and move into the mindful money moment. And so this week I want to talk about financially healthy, being financially healthy and going from being financially healthy to being financially vulnerable and understanding the phases of our financial wellness. And so this is going to take us back, but also take us into the future, just because I wanted to re-educate y'all on these terms that I learned, and so I'm a certified financial educator and when I do my financial wellness workshops, I do a lot of research.

Speaker 1:I do a lot of studying of finances, of looking at what's going on with the world, who's healthy, who's coping, who's financially vulnerable and what that picture looks like, and I think that that is a good guide. And so let me just go ahead and give credit where credit is due. I research a lot through the Financial Health Network. I'm looking at the research and reports that they have put out and thank God that they do this, especially being a practitioner of finances, I love being able to go there, go to their website, look at the research that they have put time and effort into, to seeing what's going on, to see where we stand, whether that is demographically different states, you have different genders, different races. I love studying this information about these terms that they came up with, because I believe that these terms help us with painting a picture of what our financial well-being, what it looks like.

Speaker 1:And so, if you're financially healthy, for the most part, you can just imagine yes, you're thriving financially, meaning you have more income than you have expenses. You probably have manageable debt, you're able to invest, you have disposable income, you don't have any major stresses when it comes to your finances because you have your finances in a healthy position. When you're financially coping, this means for me, you are paycheck to paycheck. You are just managing to stay afloat. Can't? No bills come in? That ain't normally supposed to be here, okay, you are sending them back like Deborah Cox? Nobody's supposed to be here, okay, what are you doing here? Nothing unexpected can happen. If it does, it's going to throw you off, throw you off completely financially. So that's what financially coping is, and financially coping leads to being financially vulnerable.

Speaker 1:This is a place where, when we've been talking about scraping by, when you're in that scraping by stage, when you are in that stage where you are living off savings in one of our episodes that we talked about you are in a financially vulnerable space. You are struggling with your basic needs, that paycheck to paycheck. The paycheck ain't even enough to pay the bills that you got. Okay, you're in constant financial distress and being in constant financial distress is hurting your health because you are stressed out, you are worried, you are having anxiety about bills being due. Y'all probably like girl, how you know, I didn't been there. Okay, I understand what that looks like, and falling from being in a financially healthy space to being in a financially vulnerable space is what we're going to be talking about, which is the same thing as the title of the series the fall when you are going from that high income earning capacity to that fall down where you're not there anymore. So now I'm just using those terms to say from financially being healthy to being financially vulnerable, because I want us to understand what that looks like, because we want to try our best not to get back in these positions, understandably, knowing that you may not be the cause and a lot of times you're not the cause of you being in this situation.

Speaker 1:A lot of times, this is coming from unexpected life events. This is the thing, right? This is when my faith comes in so much, because I'm always thinking I have so much control. I think if I do the right thing, all of the right results are going to happen. If I work this job, if I do this, if I do that, things are going to stay the same. But there are unexpected life events, like losing a job, like being laid off, like being cut your hours being cut, like sickness happening, like relationship statuses changing, like family circumstances changing All of these unexpected changes, life events that happen in all of our lives. If it hasn't happened to you, I pray that it doesn't. But for the people that's listening, when it's happened, it has taken us from being financially healthy to being financially vulnerable, and it wasn't something that we asked for, it wasn't something that we expected, it wasn't something that we thought would happen to us, but it happened.

Speaker 1:And this is the thing when you're financially healthy, you're putting yourself in a position where you're prepared, but this is the thing If something else doesn't happen to help you while you're in that state. So you may have prepared yourself for three months, you may have prepared yourself for six months. That state so you may have prepared yourself for three months, you may have prepared yourself for six months, but in that seventh month, if that change hasn't happened, you risk now being in a financially vulnerable spot and unfortunately, we are at the hand of waiting for the next job, waiting for the income to come in, waiting for whatever that change is so that we can get back into the place that we once was, or surpassed that, so that we can thrive, because nobody wants to financially just be surviving. And that's what being in a financially vulnerable space, what that looks like. I want to also talk about when you're financially vulnerable because you're in an underemployed state as well.

Speaker 1:I'm going to do a whole episode on being underemployed, because I don't believe that we talk about this enough. But your girl love talking about it. Okay, I need to be the change. Okay, I need to make sure people talking about it, because being underemployed is just not making enough money, and I see that a lot. I've been looking at TikTok a lot y'all, especially on career talk. I don't know why I'm there, but apparently the Lord want me to get a message out of some sort, and so there are a lot of people who are talking about being underemployed and I want you to understand this.

Speaker 1:If, at the job you started whenever you started, it has not increased you at the rate of inflation, you are probably in a position where you are now underemployed because that job at one point in time was enough to pay for the lifestyle that you had in that particular year. But as the years are continuing to go, most jobs are not paying you at a rate of inflation. They are not increasing your pay at the same rate that inflation is going up. So that's the reason why a lot of people you need a two income home and for us people who got a one income home, we over here, like you need a two-income home. And for us people who got a one-income home, we over here, like we got to make two-income people money okay, because we do not want to be in a position where we are now in an underemployed position.

Speaker 1:That's the reason why it's very key, if you're going into jobs now, to make sure you are looking at the rate of pay, looking at the salaries and making sure you are equating, all right, not only how much do I need to make today, but how much do I need to make for at least the next three years and thinking about what am I going to do in those next three years, because inflation is going to be going up, especially if you're a renter. You want to make sure that you are paying attention to those things, because child life is expensive. Okay, so you see how easy it is to go from being financially healthy to going to financially coping, to even being in a financially vulnerable territory. It's not hard, and if you're not paying attention to it, if you're not being very mindful of that, it can happen to you just like that. So that's the reason why we do have to make sure that we are being very intentional, very mindful over our finances, understanding once again that number one thing our income, those income streams that we have, so that we can always know where we're at in comparison to our expenses, in comparison to the inflation that's going to happen. So you can be prepared, because the idea is to make sure that we are staying financially healthy by any means necessary.

Speaker 1:And so I want to talk to y'all about a few stats. So I look these up. I want to make sure that y'all are aware of this, because I feel like I'm really good as a financial guy, because I coach so many different people, so many different economical backgrounds, and there's a misconception of thinking that because someone earns six figures, that they just made it, they all the way there, and six figures can be. This is the thing. It can be anything in a six-figure range, right? You would be surprised at how many six-figure earners are living paycheck to paycheck. As a matter of fact, the stat that I look up from paymentscom said 47% of six-figure earners are living paycheck to paycheck. I want to give you another stat, and this is for California, just because I live here. This is for California, just because I live here In California. In order to live comfortably, you have to make an income of over $113,000 annually. That is also from paymentscom.

Speaker 1:Another stat 63% of Americans reported living paycheck to paycheck as of 2023. I don't know why I said it like that 23. I don't know why I said it like that. I made that feel like it was going to be deeper than what it was. But what's not funny is the 63% of Americans that reported living paycheck to paycheck, and that's according to smartassetcom. And so another one is many high earning. I don't know why this is a tongue twister when I say it all together. Many high earning income individuals end up financially coping due to rising costs of living and lifestyle inflation, where spending increases with their income Y'all.

Speaker 1:So I've been saying this, but I also wanted to make sure that I got some facts to support this, just so that you can understand what our economy is looking like. And I have to be that one that points out these things because I'm mindfully rich. I want to make sure that you are being very mindful about your finances so that you can have the riches that you want, especially when it comes to your financial riches. And so I want to go back to it. Just because your income is so crucial, because the income is the make or break in whether we're financially healthy, we're coping or we're vulnerable. So I talked about the climb last week and talked about when you're diversifying your income, when you're building those multiple income streams, just because your income. I want you to always look at your income as being the foundation to your house. That is the foundation to your house. You can have multiple income streams that are creating that foundation. You got to figure out what that's going to be just because you don't want to be in that coping area or that financially vulnerable area. So you have to make sure that, if you haven't built your income streams to be as strong as you need them to be, I'm going back to the climb. You need to make sure that you're doing that. I'm going back to the climb. You need to make sure that you're doing that.

Speaker 1:I know we think our jobs are so secure. I'm seeing so many people go through reductions at their jobs right now. Then what? What are we going to do then? I'm seeing a lot of people who have been in situations where they've left their jobs where it wasn't their fault, something happened where they're no longer needed there. When they tell them their services are no longer needed at those jobs anymore, what do they do? So we have to make sure that, yes, I'm relying on this income. They're paying me a good wage. Yes, but what else? What else? I want to make sure I'm being that person that's telling you what else are you going to do?

Speaker 1:And I talked last week about having income come in from entrepreneurship, from your business, that side hustle, whatever it is that you're doing, but I really want you to make sure that you're looking at that. Just because our economy is volatile right now, I don't want you to be left being vulnerable. I don't want you in that space. I don't want you in that scraping by space. I don't want you to be left being vulnerable. I don't want you in that space. I don't want you in that scraping by space. I don't want you in survival mode. I want to make sure that you got everything that you need so that you can thrive All right. And so when we thriving I talked about when you're in a financially healthy space, your income it surpasses your expenses, tightening up your budget Child, I got to tell y'all last week.

Speaker 1:After the episode last week, it inspired me to go take a look at all of my expenses and I was looking at my subscriptions. So I went to Apple. So all my people who got iPhones. I went to Apple and went to not Apple. I went to subscriptions so I could see all of the subscriptions that I was paying for. I got rid of so much stuff and it probably was like over a hundred dollars of stuff a month.

Speaker 1:Y'all may say, oh, that's nothing but a hundred dollars here, a hundred dollars there, all of that stuff add up to big money. Okay, so you want to take a look at things like that. How can you tighten up? How can you trim the fat? How can you do those things? And I know I talked about this last week, but as a financial educator, I like to repeat myself to make sure that everybody is getting it. Okay, I want to make sure that you are listening, that you are understanding that, because you do got to tighten up and you do have to make sure and it's something about, it's some about looking at your bank statement. I don't know what it is that bank statement child, because you can't lie to that one. So I'm going to give this advice again.

Speaker 1:I gave this in some episodes. Oh, it's been a while since I said this, but one of my favorite methods to do with my clients is to have them print out their bank statements, have them take out three markers. You're going to have one marker and it's the thing if you spend on your credit cards, you're going to be using this for your credit card statements as well. So your bank statements and your credit card statements for the month. So you're taking those three markers. One is going to be for any income that's coming in. You're going to carry that down to the bottom so you can see it. Another market is going to be for all your planned expenses, the expenses that you were supposed to pay for, the ones that you knew that you were going to pay for. The last market is going to be to highlight all of the things that you did not plan on getting within that month, and you're going to go through it. You're going to look at that and that's going to help you with tightening up your budget so that you can understand.

Speaker 1:This is where I be going wrong through the month. I don't know what your guilty pleasure is, but your statements, they're going to show you. Ok, because we got to get tight and right. Ok, I said that last week, you got to get tight and right and I wanted to bring that up again just because, if we want to be financially healthy, it's worth me mentioning and saying twice Once you get back into a financially healthy spot. That's when we got to rebuild our savings. We got to rebuild the three to six months. I talked about this last week. I am reiterating this again just because for those people.

Speaker 1:When I did this surviving off a savings episode that was a hard episode for me to do because it was a hard reality and it was so therapeutic for me to even talk about that. But we got to rebuild ourselves. Just because nobody ever talks about, after you save the money, what happens when I got to spend the money. So when you got to spend the money, now we got to rebuild the money and don't nobody like that. And I had this question asked to me quite a bit how many savings accounts should I have? And I don't like to save all in one spot, so I like to have different accounts that do different things. Just because I don't want to be spending out of the vacation account on the emergency expenses or spending out of my maintenance account on vacation. I want to make sure I treat my savings as line items in a business. This is for maintenance, this is for vacation, this is for emergency savings. You may get down to a place where I no longer have any of those things anymore because I've been using that to live off of. Now we got to rebuild.

Speaker 1:Now we got to be strategic when we're rebuilding, but you got to understand how much can you rebuild with. When you do get to a place where you are trying to get back to being financially healthy, you get the income streams coming in, understanding how much money do I have coming in, how much money do I have going out, how much money can I save? That is the hardest thing for a lot of my clients to understand. They're like I want to save, I want to save, I want to save, but they don't have any extra money to save. Where's that money coming from? What are you stopping doing so that you can now put this money in savings? Or what income are you now going to bring in so it can now go into your savings account?

Speaker 1:Money isn't hard, but us as people, we make money especially hard because we think that it's like magic somewhere. But it's not. We have to understand we're in control of where we're going to get these income streams from. How are we going to make the money? Right Now, we ain't in control of if it's going to stay when we do get it, but we're in control of where we're going to go so that we can get those income streams flowing in. We're also in control of those expenses. Now I do understand that there are some expenses that just pop up and boom, now you got a bill. I get that. I understand that, but we want to try to make sure that we are minimizing those expenses, those debts, as much as we can, so that we can build ourselves back up when it's time to start building ourselves back up.

Speaker 1:So this episode doesn't have any tips, but the key takeaway that I want you to understand, because this is going to sum up this whole series which financial phase are you in? Are you accepting the financial phase that you're in? Because when you're financially coping, I don't know what it is. We do not want to accept that. I do not want to accept that I can no longer do the things that I used to be able to do when I was financially healthy. I don't want to accept that I can't go on vacation when I want to. I don't want to accept that I can't just be going out to eat when I want to. I don't want to accept that I don't have any extra money. I don't want to accept that I am now drowning in debt. I don't want to accept that my expenses are now outweighing my income.

Speaker 1:What do you need to accept so that you can now accept it, so we can stop scraping by and we can start thriving. What do you need to accept so that you can now get up, figure out what you need to do next? What do you need to accept so that you can now start getting the help that you need, so you can get up and you can get to where you're supposed to go? You still got more in you. You still have a journey to go on. You are learning something in this particular season that you're in and what you're learning is going to help you with thriving in your next season. But we got to get through it.

Speaker 1:So what do you need to accept now about the financial season and phase that you are in now? What are you needing? Because you need to get that. I needed to get that. I didn't want to accept that. The longer you don't accept where you're at, the longer you're going to stay in that particular financial phase because you are not in a mindset that is telling you the reality of your situation. You are in la-la land somewhere thinking, nope, I'm this. I'm still where I used to be. I get it. It sucks coming down. I know better than anyone. I don't know why I'm on God's strongest soldier list, but I've done it too many times and I don't like it, but I'm saying this again what do you need to accept so that you can move forward? Because that is what we're doing in this new season. We are moving forward and I'm going to get a little spiritual on you. Okay, you are being refined right now. I want you to know that, whatever it is that you are going through, other people are going through it with you. So I hope that you feel seen. I hope that you feel heard and know that you are being refined right now. You are being built stronger and I want you to come out of this stronger, but it's going to start with your acceptance of understanding the phase that you are in right now so we can get you back to being financially healthy.

Speaker 1:I want to speak life into you one more time and let you know that you are resilient, that you are going to have the doors that need to be open in your life. They are going to be open and they're going to be wide open and they're going to give you the reward that you need. But you have to get up. I had to hear this and it hurt me so much because so many times. You want to just lay down, you just want to be sorrowful about it. You think that it's over, but it's not over. You're still here. You woke up, your eyes are open. That means that something is waiting for you on the other side of this and you're going to see it and you're going to tell me about it. You're going to DM me so that way I can tell everybody else about it. Okay, and so just wanted to speak life for a second.

Speaker 1:I hope that y'all have enjoyed this series and, like I said, this has been a very therapeutic series for me, because this is some things that I needed to talk about, and not only was I talking about it for me, but I felt in my heart, somebody else that is listening also needed to hear this, and this is going to live. I love that this now has legs and it gets a chance to move all across the world. And, speaking of the world, y'all make sure y'all sharing this thing far and wide with your friends, with your circle. Okay, one woman team? Okay, it only gets out if y'all send it out, okay, and hey, to all the new listeners.

Speaker 1:I didn't get a chance to get everybody. I was going to list all the cities, but I don't want to embarrass y'all on here. I don't even know if that's embarrassing. I think it's cute. I think it's cute, I'm going to do it next time. And also, I didn't have all of the details prepared for advertisements Next episode. I promise I'm going to have that, because I've had a lot of people ask me about how they can sponsor the podcast, how I can advertise, what can I do? I'll have all those details for y'all next time.

Speaker 1:And so, because we've been talking about being financially healthy, vulnerable and coping, once again, you know your girl is a financial guide. I want to assist you on your journey. All of my appointments are virtual, so you could be anywhere, don't forget. I am accepting new clients for September and October, so go ahead. Check out my website. Iammindfullyrichcom Gives you all of the information that you need so that you can get started. Schedule our complimentary consultation. My schedule is up to date. I want to be there for you for your comeback. Let's do it together, okay? And don't forget to follow the podcast on Instagram at mindfully underscore, rich, underscore podcast. Did I leave anything out? I don't think I did. Don't forget. Listen, listen, listen. Go on back to the episodes that you didn't listen to after this one, and I don't want to start rambling, so that's all I got and got, no more. And until next time when I hit y'all with another one.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

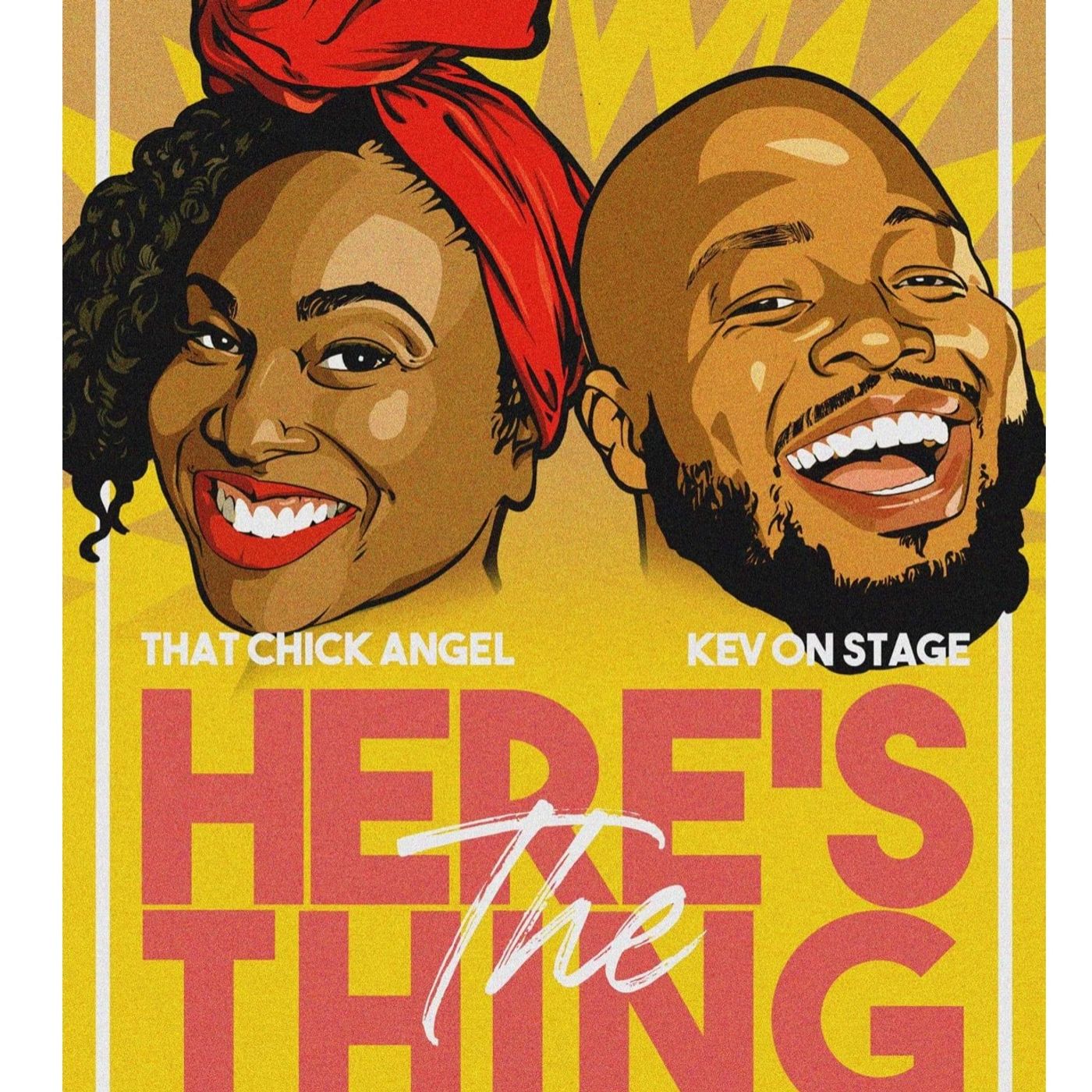

Here's The Thing

KevOnStage ThatChickAngelThe Friend Zone

Loud Speakers Network

Get Your Guy Coaching Podcast

Anwar White

Jade + X. D.

Loud Speakers Network

The Read

Loud Speakers Network

Girl CEO

GIRL CEO Network