The Mindfully Rich Podcast

🎧💰 Introducing The Mindfully Rich Podcast 💰🎧

Hosted by Gina 'RichE' Richardson, a financial wellness expert with 18 years of experience in the financial industry, The Mindfully Rich Podcast is where real money conversations meet authentic insights. Drawing from nearly two decades in corporate banking and finance, Gina offers a unique insider's perspective on the financial landscape, making complex money matters relatable and actionable.

💡 Why did I create this podcast? Because I’ve seen firsthand how financial literacy—or the lack thereof—can impact lives. My mission is to empower you to elevate your financial wellness and awareness by providing valuable insights that lead to healthier money habits. Each week, I break down the essentials of managing your money, from credit building and debt elimination to setting and achieving financial goals.

📚 Whether you're a college student looking to build a solid financial foundation or a middle-class earner striving to improve your financial knowledge and habits, this podcast is for you. Join me every Monday as we dive into real conversations about money, share practical advice, and uncover the financial truths that will help you elevate your financial game.

Don’t forget to LIKE 👍, SHARE 📲, and REVIEW 📝 to show your support for the podcast!

Topics Covered:

- 📈 Credit Building and Rebuilding

- 💳 Debt Repayment and Elimination

- 🎯 Money Goals and Financial Planning

- 🧠 Real Financial Wisdom and Practical Advice

Hashtags: #TheMindfullyRichPodcast 🎙️ #MoneyPodcast 💵 #FinancialWellness 🌱 #MoneyMatters 🏦 #CreditBuilding 💪 #DebtElimination 🚫 #FinancialGoals 🎯 #FinancialLiteracy 📚

The Mindfully Rich Podcast

Conversation #133 | Cashin' Out: How To Claim Your Unclaimed Money From Your State Episode

💰 In this episode of The Mindfully Rich Podcast, I guide you through the process of finding and claiming unclaimed money that could be owed to you! 😲💵 Drawing from my experience as a Financial Educator, I explain how millions of dollars 💸 are sitting unclaimed across the country, waiting for people like you to come and claim what’s rightfully yours. 🏆

I provide a step-by-step guide 📋 on locating and recovering your money from your state's unclaimed property treasury website, covering everything from searching your name 🔍 to submitting your claim 📝. You’ll also learn about common types of unclaimed money, like forgotten paychecks 💼, utility deposits 💡, and even tax refunds 💸.

Whether you’ve never checked for unclaimed money before or you’re not sure how the process works, this episode will empower you to find and claim what’s yours. 🔑 Don’t miss out on the opportunity to boost your financial wellness with money that’s been waiting for you! 💸✨

Key Takeaways:

- 🔍 Learn how to search your state’s unclaimed money and property website

- 💸 Understand the types of unclaimed funds you may be eligible for

- 📝 File a claim quickly and easily without paying any fees

- 📅 Start checking regularly to ensure no money goes unclaimed

💰 Don't miss out on this hidden financial gem!

Visit www.iammindfullyrich.com for more financial tips and to schedule your consultation with me! 💻

📲 Follow on Instagram: @mindfully_rich_podcast

🎙️ Hashtags: #MindfullyRichPodcast #FinancialWellness #UnclaimedMoney #MoneyManagement #ClaimWhatsYours

Hello, hello and welcome back to the Mindfully Rich podcast, your weekly look at life and finances with a twist, where we talk about improving your overall relationship with money and building better financial habits. On each episode, I'll discuss real life situations and give y'all practical advice. The point of this podcast is to help you stay in your financial lane so you won't end up broke. I'm the creator and host, gina Ritchie Richardson. Now let's jump into today's conversation. What's up y'all? We back, we back, and it is week five of Consistency, might I add, for everybody. That's counting. Okay, I know I'm counting. Okay, y'all don't have to be because I'm excited. This season. Your girl got that fire. I am ready to talk. I have been gone. Here is my story. That's what I'm on this season. Of course, I always got to start with gratitude. I am so grateful and thankful that I have y'all as my rich gang, as my listeners, because y'all are sharing these episodes far and wide. I know because I look at the stats like who I know over there? Okay, I know, I don't know them. I know you know them. Thank you for spreading the word. This is a one woman team over here. We're going to build this up, okay, so keep me in your prayers. Okay, but one woman team right now. So thank y'all so much for sharing these episodes far and wide.

Speaker 1:Word of mouth is the biggest way that people buy, listen, do any of the things that they're doing in life. When you're looking for something and somebody tells you about it and you're like, oh, I should go get what, then you go buy it. Or if someone says, go listen to this, that's when you go listen. So that's the reason why I'm always staying on this Like y'all, make sure you are sharing. You never know who needs these episodes. And, speaking of these episodes, the last series that I did, man, if y'all haven't listened to all four parts of that, it was really good, it was really deep, it was very therapeutic for me, just because in the opening I always talk about ways so that you don't end up broke.

Speaker 1:I wanted this podcast to be a way to keep you in the financial know, to keep you up on your money management, to keep you on point financially right, but there are times, financially, where you just going through it, and one thing that I did my homework on was going back and looking at all of the episodes that I've done and looking at the episodes that have the most listens, and a lot of those listens come on those episodes where I'm talking about your rebuilding or talking about turning around, talking about when you're in times of transition. So I said you know what, especially since I'm going through my own time of transition? I'm going through my own time where I am trying to reclaim and build myself back up, build a better foundation so I can build myself higher. I said I have to talk about these things because I know if I'm going through this, there's someone that's also going through this, going through something similar. They're at a different stage of it. I need to bring notice to it because this is life. Life ain't just going to be the good times, unfortunately. I'm old enough to know that. Y'all old enough to know that that there are going to be times where we got to be in our building season and a lot of people are there.

Speaker 1:There is a lot going on economically, financially, for people right now, and I want to make sure that I'm being that voice, that I am keeping my ear to the ground, that I am continuing and maintaining my realness and talking to y'all about the topics that may feel uncomfortable, but we still need to get them out, because awareness is key, and I talked about that in the last episode, where I talked about you have to not only be aware, but you have to be accepting of the situation that you're in, so that you can move past this, so that you can get to the next stage, so you can build yourself up, so you can get to that next. What is the ladder call? What's the things on the ladder call? I don't know, but you can go up the ladder child. I don't know. I don't know what it's called. So I want to make sure that I'm continuing to do that and I'm going to always be that voice for that. So I want to make sure that I am saying thank you, thank you, thank you to everyone for listening, thank you for all the DMs, thank you for reaching out, thank you for sharing with me how these episodes have impacted you. And while you're sharing it with me, share it out loud, share it out loud on your social media, tag me in it, put it out there to the world so that they can know, so that they can listen, and I appreciate all of y'all in advance for doing so.

Speaker 1:And so I want to go ahead and recap last week's episode. So it was from financially healthy to vulnerable, and I was talking about understanding the phases of your financial wellness, understanding that there are different stages that we can be in. And I mentioned being financially healthy, which is the stage that we all want to be in. Being financially coping, which is a stage where you're in that paycheck to paycheck mode Can't nothing go wrong because you got just enough to get by. And then also being financially vulnerable, where you don't have it. You may be trying to live off your savings. You may be in a situation where you don't have enough money coming in. You can't pay all of your bills. It's not a good time. And I wanted to talk about those different stages because financial wellness is a spectrum. We have our times where things are good. We're going to have those times where things are a little shaky. We're going to have those times where things are challenged. It's just a thing that happens in our life. It's something that also can happen in our finances and I broke that down pretty well in that series along within that episode.

Speaker 1:So if you haven't listened to those, after this one you already know what to do. Go ahead and go back and, once again, share, share, share. Social media shares. I'm here for those. The Facebook, twitter, oh, what is it called? Now, x? I don't think people be sharing real stuff on X, no more. I think they just be talking Child, instagram, tiktok, wherever it is that you at Snapchat, for those of y'all that still on it, wherever you at, share it, share it, share it. Okay. So let's go ahead and move into our mindful money moment. So, ahead and move into our mindful money moment. So I know, for the last four weeks it has been, we've been on it Like I've been on next, okay.

Speaker 1:So I decided to lighten the mood this week. I wanted to talk about something happy, something that could bring you joy, and I want y'all to make sure that you tell me wait, I can't say it now, cause now I'm getting ahead of myself. Anyways, I'm gonna tell y'all in the end. I'm going to tell y'all in the end. I'm going to tell y'all in the end Moving on, moving into the mindful money moment, because I'm so excited because I get to talk about something that's more joyful today, and so this week I do got a song, okay, cashing out, okay. I don't know if y'all remember that song, but that used to be my song. It's still on the playlist but I don't listen to it as much as I used to. But the reason why I called the cashing out? Because I want to talk to y'all about how you can claim your unclaimed money from your state. I know that that is a long title. That's all I know how to do. I talk a long time. That's it. I use a lot of words. That's just where I'm at, okay. So, like I just said, I am super excited to talk to y'all about how you can claim unclaimed money and property that your states hold.

Speaker 1:So a lot of y'all may not even be aware that there are websites designated to your state's Treasury Department of Revenue, owed money from, say, a financial institution like a bank or a credit union, an insurance company. If you have rents or deposits that you've paid or overpaid and they need to get the money to you. If, say, walmart, target, somebody, if anybody owes you money in that particular state, there is a website that you can go to for your state and you can look up your name, your address and you can find monies that are owed to you. I know y'all are sitting there looking like you can. You absolutely can. I got money owed to me right now and I check this thing every year just because you don't know if you're owed those money, if somebody had you overpay something, and I'll always be thinking inside my head I know I paid this, but it be those times where you know you paid this, you overpaid, and then now they have to give that money to your state's treasurers Department of Revenue so that they can get that money back to you. So you can go on the website.

Speaker 1:So this is just the general website. It's wwwunclaimedorg. You can go to your state's link from there. You don't have to do all that. I want you these are the steps, because this episode is going to be kind of light. I'm just talking to you because it's not really too step by ste-steppy, we don't have to make it into that. I'll say and of course you can just go back, rewind, go listen to what I just said, so that you can get your money.

Speaker 1:I want you to Google your state and put in your state unclaimed money and property. The link should pop up. If it don't pop up for some reason even though I didn't try it for everybody's state you can go to wwwunclaimedorg but Google your state, say unclaimed money and property. You can put treasury, whatever keywords that you want to put in there, and it should bring everything up. It's going to tell you about the site, what it is, how you do it and what you're doing is you're trying to find a match. So the one thing that I can say is, when you get on this page and you're entering your information, sometimes your name may be misspelled. You're going to have to put in different addresses of where you live just in case they miss something, because I went on there and my address was wrong. My name was spelled wrong, like my real name is spelled with an E and some people spell it with a U. I have no idea where they got that from, but your name may be misspelled. So you want to make sure that when you are entering your information, you're putting it in there different ways. Put your name in there, put your middle name in there, put different addresses that you've lived in in that particular state, so that way you can find your money. And what you're doing is you're checking for those matches and you're looking for your payouts, and one thing that they do they let you know is this under a hundred dollars, is it over a hundred dollars, like y'all may find some money money.

Speaker 1:I went on there for my state and also all of the states that I've lived in. I grew up in Chicago in the state of Illinois, looked up Illinois first, cause I'm like I ain't been looking for no money here in forever, so looked up money there first. I've also lived in Florida. I've lived in Mississippi. I lived wait, where I'm trying to go with that. California. I'm like, wait, where else I live. I was sitting here thinking about it Like, oh, was there another one Like I? I thought I had like a running list and that was the end of the list. So I felt a little salty on that one. But I look in all of those States and all I did was Google that States unclaimed money and property. So Texas unclaimed money and property. Illinois unclaimed money and property. Mississippi Y'all get what I'm saying.

Speaker 1:Sometimes you just got to. You know everybody listening. You all want to make sure everybody get it, okay. So you want to make sure that you are Googling that and you are getting on those sites putting in your information. Remember you're putting in your name, you're putting in middle names. You know doing different variations. You're doing that along with your addresses. Addresses is key because it could be a different address and they may even have the address misspelled because other people that's what I wanted to keep you in mind of other people have your same name. They may not have the same exact spelling of the name or the same exact middle name or any of those things, but you have to make sure that you're looking at the name, you're looking at the address and making sure that you are linking it to yourself. It may be.

Speaker 1:I'm going to give you another example. I had money that was linked to my grandma house because I lived at my grandmother's house, so it may be an address that you're associated with as well. The reason why I'm telling y'all about this is because there is too much money that the Department of Revenue for your state has and you want to make sure that you are getting all your coins. Okay, I've been talking about hard times for the last four weeks. I am talking about some good times. Right now. I want you to make sure you are going to cash out and go find your money, and I am telling you the way to do it.

Speaker 1:Do not pass this episode up. This is the episode that you send to everybody, because everybody needs to find their money. So I want to go over that once again. I want y'all to go to your state's unclaimed money and property. Just put in the state. Put in unclaimed money, property, whatever other keywords you want. This is money that is owed to you. Once again, these monies are official money. This ain't a scam. This is official money that is coming to you from a bank account that you may have had, insurance that you may have had. You may have been owed a refund from, say, a department store, a company, a renter, whoever it is that you pay, who you may be owed a refund from, everybody is obligated to give those funds to your state's treasury Department of Revenue so that they can get those monies back to you.

Speaker 1:And what am I doing? I am being an angel of the Lord and I am telling you how you can reclaim your money. Okay, that is what I am doing and it's free, and I would encourage y'all to check for unclaimed money and property every single year. Put like something in your calendar. Each year on your birthday, check for this money because, child, I don't know if y'all know this, but there is nearly 49 billion in unclaimed money and property all across the US 49 billion. I want y'all to be a part of that number and get your money back. Your money is waiting for you, okay, so make sure y'all are checking that and, like I said, set a reminder each year so that you can check the money and make sure you're checking every state that you lived in. I just told y'all it is 49 billion in unclaimed money and property out there waiting for y'all. So make sure that you go and tell your family and friends, send them this episode and then y'all put it on y'all social media so other people can do it too. Okay, I think I've made myself very clear this episode. All right, y'all, this is a short one because I didn't gave y'all a long one child. That's it. That's it. Go get your money. I want y'all to tell me about the money that you was able to claim. Put it on your socials, let everybody know, especially if it's a big amount, because I want to see how much y'all claiming of this 49 billion. Okay, all right.

Speaker 1:So before we get out of here, I am booking new clients for September and October, so y'all check me out on. I am mindfullyrichcom If you want to get your consultation, see if we are matched. Your girl would love to get you straight. I've been talking a lot about getting you on your way in your finances, so hit me up. I am mindfullyrichcom. All of the information on how to work with me is there. If you would like to book me to speak to your audience, your church, your business, whomever it is, let's get to work. Let's get a plan together. Let's figure out how we can get some financial wellness initiatives going for y'all and your girl love hosting, so check me out, okay. So I am mindfully richcom is where you can find all of that information on how you can work with me. And in the words of my favorite YouTuber, funky Donnieva, that's all I got and got no more. And until next time when I hit y'all with another one.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

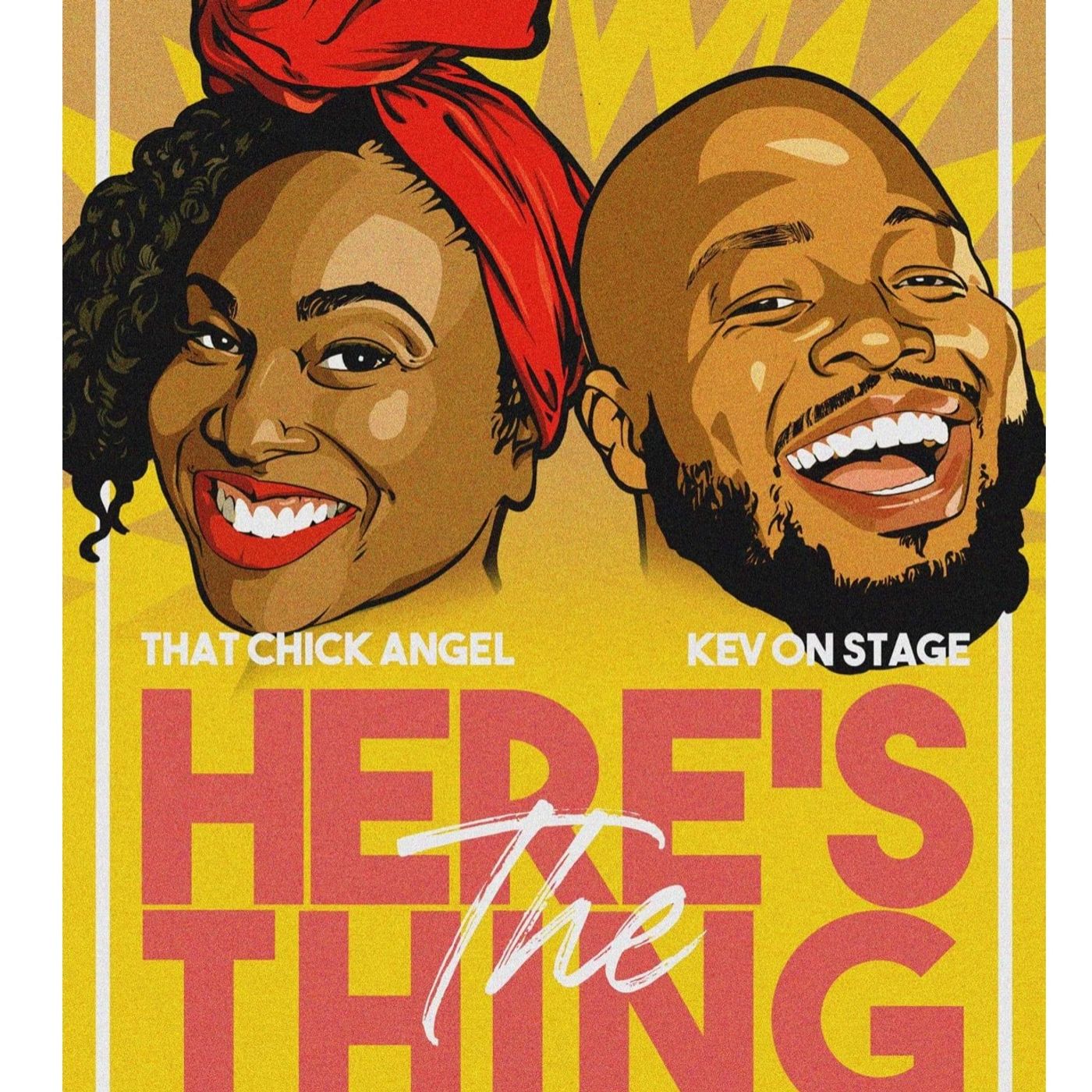

Here's The Thing

KevOnStage ThatChickAngelThe Friend Zone

Loud Speakers Network

Get Your Guy Coaching Podcast

Anwar White

Jade + X. D.

Loud Speakers Network

The Read

Loud Speakers Network

Girl CEO

GIRL CEO Network